child tax credit 2021 calculator

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 3600 for children ages 5 and under at the end of 2021.

New 3 000 Child Tax Credit Payments To Start In July See If You Re Eligible Krqe News 13

Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

. The american rescue plan expanded the amount of child care expenses families can claim per child from 3000 to 8000 for a maximum of two children while increasing the. Year 2021 -CTC Refund Rules. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return.

The 2021 Child Tax Credit or CTC is a fully refundable tax credit for qualifying individuals. One of the big changes this tax season was the temporary expansion of the Child Tax Credit that broadened the benefit in three key ways that helped many families in need. For tax year 2021 the Child Tax.

You get to claim the lesser of 15 of your earned income above 2500 or your unused Child Tax Credit amount up to 1400 per qualifying child. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

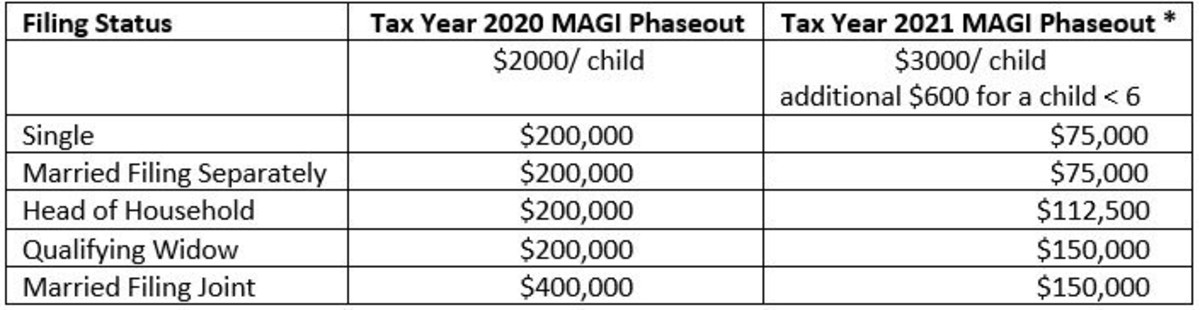

The expanded and newly-advanceable Child Tax Credit for 2021 was authorized by the American Rescue Plan Act enacted in March of 2021Part of this expansion is to advance a. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. Our child tax credit calculator will help you estimate your refundable child.

Changes in income filing status the birth or. According to the IRS. You will get the additional one-time GST credit payment if you were entitled to.

3000 for children ages 6. The Government of Canadas Affordability Plan includes an additional one-time GST credit payment. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of earned income to qualify for.

There are seven federal income tax rates in 2023. For instance if you are filing for a single return and your. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021.

It is fully refundable for 2021 only. Have been a US. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

The child tax credit provides a financial benefit to Americans with qualifying kids. The child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year. For other tax years it is partially refundable.

What You Should Know About the Regular Child Tax Credit from 2019 2021. The tool below is to only be used to help. The increased child tax credit is reduced by 50 for every 1000 income above the thresholds.

For tax years before 2021 the IRS allowed you to claim up to 2000 per child under 17. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Under the Tax Cuts and Jobs Act TCJA the following child tax credit rules will take place between 2019 and.

Child Dependent Care Tax Credit Calculator 2021 2022 Efile Tax Advisor

2021 Child Tax Credit Earned Income Tax Credit Child Dependent Care Deductions Alabama Cooperative Extension System

American Rescue Plan Act Of 2021 And Divorce Planning Child Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Premium Tax Credit Beyond The Basics

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Three Things You Need To Know About The Advance Child Tax Credit Payments New York Legal Assistance Group

Advance Child Tax Credit Payments Have Started Here S What To Expect

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Ready To Use Child Tax Credit Calculator 2021 Msofficegeek

2021 Child Tax Credit Calculator Kiplinger

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Kff Kaiser Family Foundation On Twitter The Americanrescueplanact Expands Tax Credits For People Who Buy Aca Marketplace Coverage Our Updated Calculator Shows What People Should Expect To Pay In Premiums Under The

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

How To Claim The Child Tax Credit If You Didn T Work In 2021 Wcnc Com

Expanded Child Tax Credit Everything You Should Know The Everymom

Child Tax Credit Don T Make Mistakes When Filing Tax Returns Fingerlakes1 Com

Refund Advantage A Division Of Metabank Child Tax Credit Calculator Help Families Understand Actc